Housebuilding is still at a historically low level but what is being built is at the higher end of the market – some of it at the very top of the market. That is good news for the producers of British stone and specialists processing and fixing it.

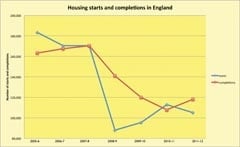

Housing starts seem to have settled down at a little over 100,000 a year in England and about 135,000 for the UK in total. The monthly figures have fluctuated during the year, variously giving rise to optimism or pessimism, but the overall picture is largely flat at a level around 30% above the low point of 2009 – although that is still only half as many as were being built before the 2008 crash.

Seasonally adjusted figures from the Department for Communities & Local Government show housing starts in England in the 12 months to June 2012 totalled 98,670, down 10% on the same period the year before.

Private enterprise housing starts, which currently account for about three-quarters of all housing activity, were 7% lower in the quarter to June while starts by housing associations were 23% lower.

Clearly the level of activity in house building is still depressed, although there are those who see this as potentially good news because a limited supply of houses will lead to a rise in property prices if demand grows.

The chartered surveyors of RICS believe a house price recovery will boost the sector and take comfort from a rise in rents of 4.3% in the past 12 months which they see as a result of a scarcity of mortgage finance and a shortage of good quality properties.

The Council of Mortgage Lenders says buy-to-let lending has increased by nearly 20%, prompted by rising rents, although the volume of lending is still only about a third of its pre-2008 peak.

According to PricewaterhouseCooper, property is still a reasonable investment. It predicts house prices will rise an average of 2% year in real terms between 2012 and 2025, again with a shortage of homes pushing up prices once demand recovers.

With the current expectations of returns on investments that is not bad, although between 1984 and 2007 the return from property was about 4% a year.

Any shortage in housing might be relatively short-lived if Government moves to make it easier to get planning permission are successful.

Even if they are not as successful as the Government hopes, there are a lot of consented projects waiting for signs of improvements in the economy before builders move on to site.

The Local Government Association says there are some 400,000 plots across England and Wales with planning permission. That is 25% more than previously thought. Building work has only started on half those sites.

The relatively low level of activity in the market does not benefit the manufacturers of any housebuilding products, and that includes those British stone producers who offer walling of one kind or another. Nevertheless, many of the stone companies have not been as badly hit as the makers of bricks and concrete tiles.

One of the reasons for that is because it is the lower end of the market that has suffered most. With the tightening of lending from the banks and building societies, and with parents no longer so keen to remortgage the family home to buy starter homes for their children, a lot of first time buyers have dropped out of the market.

With the Government’s Montague Plan published in August requiring local authorities to favour the private rented sector rather than insisting on so much ‘affordable housing’ in development plans, there seems to be an acceptance that youngsters leaving home are more likely to have to rent in future than to buy.

Starter homes are not renowned for their use of stone. Further up the market, much more stone is used. And if developers do not have to include so many ‘affordable homes’ in their projects but can concentrate on higher value buildings they are more likely to use stone, even if it is even now sometimes at the insistence of the planners. Many builders want to include stone because of the extra value it puts on a property, but there are still those who are simply looking for the cheapest products they can find.

It is the higher end of the market, both for new build and for renovations and extensions, that has been keeping stone suppliers ticking over, even if they are not as busy as they have been in the past.

The very top of the market – the

neo-mansion level – has also been buoyant.

As most of the British stone producers, as well as the masonry companies working and fixing the stone, are relatively small operations they do not need many mansions to keep them busy. And as most people building a mansion want it to have walls of stone, as well as stone floors, fireplaces, columns, bathrooms, kitchen worktops, hard landscaping, fountains and whatever else takes their fancy, such projects have been the saviour of companies that have won the contracts to supply the stone for them or to build them.

It is a safe bet that some of the mansions built in the past few years will be among the winning projects in the Natural Stone Awards being presented at Lord’s cricket ground on 30 November by Kevin McCloud, the presenter of Channel 4’s Grand Designs programme. You can book a place at the Awards ceremony with the Stone Federation (see page 43 for details), although NSS readers who do not attend the ceremony will be able to see and read about the winning projects in the Awards Souvenir Programme that will be included in the next edition of this magazine.

Even a level slightly below the

neo-mansion has been active. Iain Kennedy, the Managing Director of Realstone in Derbyshire, says all bar two of the houses Realstone has supplied stone for in the past three years have used ashlar rather than split-faced walling.

Realstone (and its quarry company, Block Stone) has not been a major supplier to housebuilders but has found a ready housing market, especially in Newcastle, for the Blagdon stone the company has introduced lately (see NSS July issue).

Iain Kennedy says: “When you have a recession there are two types of people not affected: Farmers and people who already have money. They are smart and say everything’s gone cheap, I’ll get a very good deal here.”

Unfortunately, the person who will end up owning the property is not usually the person buying the stone and at the end of the project there is the usual debate over the final settlement, although Iain says: “Most people are honourable enough to pay in the end.”

The story is much the same from stone producers all over the country. It is hardly a surprise that there are not many major housing programmes running where hundreds or even dozens of houses are going up at a time, with or without stone walls.

It is, perhaps, remarkable that quite so many larger houses are being built, and as Sean Berry at Johnsons Wellfield Quarries says: “It’s surprising how many people appear to be recession proof.”

Paul Allison at Dunhouse, in County Durham, is having the same experience. “We’re not seeing any of the big developments but we are and have been involved with a few smaller sites of up to 20 units. These are generally in a good location built to a reasonable spec. The builders are looking to put forward a desirable product at a reasonable price to encourage people to move and our walling has an important part to play.

“We are also involved with a few high end properties for those people with the means to take advantage of what they see as a weak market to get a good deal within tight time constraints.”

For some, the difficult market conditions have had more severe consequences. Kirkstone Quarries in Cumbria has gone into receivership, although operation of its quarries has been taken over by Burlington, Stancliffe Stone has closed down its Grange Mill site in Derbyshire with the loss of 49 positions and Natural English Stone Company in Northamptonshire has now been dissolved.

Stancliffe is owned by Marshalls, its walling complementing Marshalls’ hard landscaping products, including domestic driveways, patios and consumer landscape products. In its annual report it says its target customer groups for installed patios and driveways occupy 8.9million homes, a far bigger potential market than new build.

These customers are generally older, have equity in their property, earn more and often have savings. It says an ageing population with a retired lifestyle should continue to drive sales growth.

It adds that quality installers remain busier and that Marshalls has built a substantial and growing network of around 1,800 approved domestic installation teams throughout the country. In 2010 it started its Marshalls Register of approved installers which has continued to grow.

Even in the genteel Cotswolds, where the local stone has contributed much to the character of the towns and villages and where many of the wealthiest people have had their new houses built, the stone companies have known better times.

Tim Wright at Cotswold Hill Stone & Masonry says he is “plodding on” rather than busy but is finding enough new builds, extensions and conversions of old buildings to keep him that way.

He says the production of building stone for facing houses is still providing good business in the Cotswolds and that with modern machinery it is easy to “fire out a few metres of building stone” sawn top and bottom and with a split face.

At Farmington, another of the Cotswold quarries, Richard Barrow says he has detected a slight upturn lately and has received some good enquiries for developments at the upper end of the market, which can always put a spring in the step. He says Farmington is currently supplying the stone for and building a 14 apartment development in Bath and supplying stone only for a number of four and five bedroom houses in Bradford-on-Avon. There is also more work coming from projects in London.

“It’s not all doom and gloom,” says Richard, although, on the down side, the company’s fireplaces, which were once an important part of its mix, have been hit by the fall in the number of new houses being built and the financial squeeze away from the higher stratas of the economy. “The retail market is quiet,” says Richard. “Flooring is sporadic as well.”

In Cornwall, DeLank granite has not made quite the impression on the housing market that Adrian Phillips of Black Mountain Quarries in Herefordshire hoped it would when he took over the quarry.

Adrian thought that by concentrating production on the domestic market and bringing prices down he would see sales increase. He has cut prices of DeLank to below the price of imported granite but says: “Developers down here have got out of the habit of using stone. I don’t think we are losing any jobs to imports but they’re just not using stone in Cornwall. I’m struggling to understand why because there’s a lot of pride in the county.”

On the up-side for DeLank the stone is being used in London again for kerbing on the City’s roads.

In Herefordshire, demand for Black Mountain Quarries’ stone for housing is stronger and Adrian says he still has reason to be grateful to local authority planners who insist on the use of sympathetic materials on new build, renovations and extensions.

“What we have found is that there’s some movement out there, but not as much as there might be and when people are using stone they are using it selectively rather than for the whole house. On a

self-build or private build they will use stone, but developers… they don’t want to add to the cost.”