Report : Housing

With prices squeezed after the housing bubble burst in 2008 some builders turned to reconstituted stone to save money. With prices now back at all-time highs in many parts of the country, building stone sales are on the up.

Although house building seemed to come to an abrupt halt during 2008 and stone producers certainly did see sales of building stone fall sharply, for many UK stone producers the fall was not as severe as it was for the producers of other building materials, notably bricks and blocks.

Certainly some builders and developers turned to concrete-based produced for some of their projects – often using natural stone at the front of a development and reconstituted stone further into it – but this was offset by an increase in the number of one-off large houses and mansions being built.

The volumes of stone sold fell but much of the value was retained. There was less walling but more higher value architectural masonry. The relatively small scale of British stone production did not need too many projects of this nature to remain busy.

This year there has been some increase in housebuilding and an even greater increase in house prices. According to the National House Building Council, in the three months to the end of May, there were 35,150 housing starts, a level not seen since May 2008 and 10% above the same period in 2013. There were also 143,600 plots under construction, 9.2% more than at the same time last year.

The increase in building activity has seen more stone being used on small to medium sized developments but the substantial upward move in prices of the past two years has probably contributed more to the return to natural stone. Developers know houses will be easier to sell and in a normal market will command a premium price when they are built of stone, and although some still carp at using it, most will now encompass it.

Quarry operators across the country that sell stone for housing tell the same story of business picking up. As Dan Wilson at Stamford Stone at Barnack in Rutland told NSS: “Sales are up – we’re seeing it right across the board.”

Just lately there have been signs of a bit of nervousness in the housing market in general in anticipation of a rise in interest rates next year, although the increase expected in February is now looking less likely. Whenever it comes, it will impact mostly on

first-time-buyers, but if they cannot buy, others cannot trade up and the market slows. Dan Wilson is not unduly worried for the moment. “To be honest, we have enough work ahead of us.” He says builders in the Cotswolds and Northamptonshire, which are the main markets for Stamford Stone, are not planning on cutting back their plans for next year at the moment.

“We’re not back to the night shifts we had before the recession but we seem to be heading back towards pre-recession times,” says Dan. And it is not just walling and architectural masonry, either. “Flooring is absolutely flying and we’re looking at a new production line for paving.”

At nearby Clipsham Quarry Company, where a cropped walling business is leased space in the quarry, Alan Thomas says sales of cropped walling this year could be nearly 50% greater than last year – in fact more than that, because the stone has also been supplied to other companies that are cropping it for walling.

Alan says Clipsham is currently supplying 30-40tonnes of cropped scalpings every month to a customer who had a garage built of it first and liked it so much he is now having a new house built of it for himself. It is also supplying stone for a new house being built in the Cotswolds. More than 800tonnes of Clipsham has already gone to that project and there is more than that still to be delivered.

Alan is forecasting that total sales of dimensional stone from the Clipsham quarry this year will be more than 10% up on last year.

On the other side of the country on the Herefordshire border with Wales, Adrian Phillips of Black Mountain Quarries and DeLank in Cornwall says sales of walling stone are on course this year to be 33% ahead of last year.

Adrian entered the stone market by supplying his own and imported stone for roofing but he says that market has suffered more than most parts of his now much expanded business during the economic downturn. Part of the reason for that, he believes, was the diverting of money from the Heritage Lottery Fund to the Olympics, because a lot of the stone roofing market is accounted for by the heritage sector.

DeLank Quarry is supplying stone to a major development by the Duke of Cornwall (otherwise known as Prince Charles) on some of his land in the county (as reported on naturalstonespecialist.com when the Prince visited his development at Tregunnel Hill and spoke to Adrian Phillips about the stone in June). The Prince is making such a great contribution to alleviating the UK’s housing shortage that DeLank Quarry is likely to be supplying his projects for the next 40 years, although Adrian says in general housing has not provided a lot of work for DeLank, which is busy on hard landscaping projects.

While living through the peaks and troughs of economic cycles can be uncomfortable, to say the least, looking at some of the figures over a longer period and breaking them down into different parts of the country puts them into perspective.

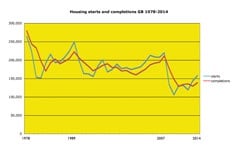

As the graphs here show, the decline in housebuilding has been a trend that has been going on for 40 years, in spite of the efforts of successive governments to try to reverse it. And the market is anything but consistent across the country. While house prices have been on an upward trend since the end of World War II, there is growing disparity between London and the South East and the rest of the country that the recession has exacerbated. While house prices in London are now 40% above their pre-recession peak, in Northern Ireland they are 46% below it.

There are now 27.8million residential properties in the UK. In the financial year to the end of March, 148,850 were built. In each of the years 2007-08 and 2008-09 about 220,000 were built.

A lot more houses could be built. Figures released on 1 October by Barbour ABI, show that planning permission was given for 238,000 homes between September 2013 and August this year, while contracts have been awarded for building only 129,000.