Report : Housing

Although the number of houses being built seems to have stopped falling and stone remains popular, suppliers are nervous.

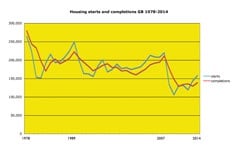

Many UK quarries producing walling stone have fared better than might have been expected in a market that saw housing starts in England fall by 44% in 2008 and a further 22% in 2009 to hit a low of 78,000.

It is not entirely surprising that British quarries should have been hit less severely than the makers of most building products because stone walling and architectural details tend to be used in more up-market homes and mansions, and it is in this sector of the market that houses are still being built and bought. It is so-called ‘affordable’ homes that have suffered most from the downturn because they are not affordable to the people who want to buy them now the banks have stopped the 100%-plus mortgages and cash-back offers and parents are less keen to re-mortgage their homes to stump up a deposit.

The massive reduction in building activity has devastated the kitchen worktop sector of the stone industry and interiors in general. But walling stone continues to be in demand in many of the traditional stone building areas of the country for the same reasons demand for it grew to such high levels in the late 1990s and continued to increase after the turn of the century – aesthetics, added value, planning controls and a desire for distinctive and environmentally friendly local products.

Housing starts in England shot up again last year by 31%, even though that only brought the number back up to 100,000, which is still 43% lower than its peak in 2007.

This year’s figures are ambiguous so far. There was a year-on-year rise of 3.5% in the first quarter followed by a 16% fall in the second quarter. (All the figures above are from the Government’s Department for Communities & Local Government).

Other housing market indicators are also ambiguous. Hometrack, the property data specialists, published a survey last month (October) in which they said house prices fell again in September. Although the fall was only 0.1% it was the 15th consecutive monthly decline. Hometrack also said the gap between asking prices and actual sale prices was increasing, indicating prices are still falling.

The Council of Mortgage Lenders (CML), whose members are banks and building societies, says gross mortgage lending fell 2% (month on month) in September to an estimated £12.9billion, although that is 4% higher than in September last year. For the third quarter as a whole, mortgage lending increased 15% on the second quarter and 2% on the corresponding period last year. The level of fluctuation (which is reflected in all sectors) indicates the difficulty markets are having understanding the current economic crisis.

CML chief economist Bob Pannell observed: “Both house purchase and remortgage lending appear to have fared well in September, but this is against the backdrop of subdued levels of activity.”

He said: “Short-term economic prospects for the UK are not favourable. The housing market is very sensitive to wider household confidence and this seems likely to weaken over the coming months in response to the latest spike in consumer prices and headline unemployment figures.”

Those still building houses are aiming at a sector of the market less susceptible to being influenced by wider market factors. And they are aiming to make their properties more attractive by including features such as stone walls outside, and stone fireplaces and floors inside. Granite worktops in the kitchens are still de rigueur, but there just aren’t enough of them to take up all the slack created by the houses that are not being built further down the market.

For evidence of the importance of stone to buyers you need look no further than the advertisements of estate agents. If a house is stone, the fact is flagged up as a main selling point.

Of course, British quarries tend to be fairly small operations and a relatively small number of developments can keep them busy. Many say demand for their stone has been better this year than last, although the snow at the beginning and end of last year, which stopped quarries working and truncated the building season, seems to have had as big an impact on some of them as the economy. After the exceptionally cold winter this year, the weather has been better throughout the rest of the year , which has been reflected in the higher level of activity of some of the quarries.

But they say the market has changed. It is volatile. Forward orders are few and developers are reluctant to part with their money to pay for products until the last minute. There are more bad debts resulting from company failures. Prices remain competitive. Even those quarries that are doing well do not express much faith in the future. And while machinery is being up-graded and replaced, investment is cautious.

At Black Mountain Quarries in Herefordshire, for example, Adrian Phillips has just bought a new Steinex cropper. He would like to put one in at the DeLank granite quarry in Cornwall that he took over this summer… but not yet. DeLank is stacked to the roof with work,” says Adrian. “It is supplying the stone for a fantastic private house at the moment – in Cornwall it’s DeLank or slate.

“Once we get sorted we can price DeLank back into the market more. It’s something we’re going to be pushing – we’re taking on another person just to push the building stone side.”

There is still strong demand for the red sandstone from Black Mountain’s Callow Quarry in Cheshire, another wealthy part of the country where high end development is continuing. “Probably quantities have come down compared with what they were but there’s still some good quality private projects going on,” says Adrian. He points out that for those who can afford it, now is not a bad time to be investing in property.

Before the crash, Black Mountain Quarries introduced a low cost natural walling Z-shaped panel system to appeal to more price sensitive customers. That is now finding itself in competition with reconstituted stone more often.

Black Mountain Quarries came into the stone market with natural stone roofing products, both imported and indigenous, and still specialise in supplying them. Demand for English stone products has held up best but roofers do not want to place an order until the roof is ready for the tiles to go on. “Nobody wants to make part-payments.”

With everything on shorter timescales, work is more frenetic. “We try to work in a healthy state of panic,” says Adrian. “Perhaps we were all getting a little bit too complacent before – the next job was always going to come in. Now we have to go out there and get it.”

Stamford Stone are another supplier of British stone for housing. They sell their own Clipsham stone and stone they buy in from other British quarries. Most of it is sold for housing, although a higher proportion of it has been ashlar since the crash and less of it random walling, indicating the wealthier status of clients in the attractive towns and villages of Northampton, Cambridgeshire and Rutland, where most of their stone goes. They find more of the projects they supply includes features such as mullion windows and stone cills and Stamford Stone have one saw dedicated purely to the production of quoins.

Ivor Crowson, one of the Directors of the company, says they have never stopped being busy, although they are not quite as busy as they were at the start of in 2008. “We’re getting fewer telephone calls but we’re still employing the same number of people and we’re working almost hand to mouth because we haven’t been able to build up any stock.”

It ought to give him confidence, but… “I wish I could say I was optimistic. I’m optimistic regarding our business but not for the economy in general.”

Cotswold Natural Stone have a similar story to tell. They started out in a small way processing other quarries’ stones 20 years ago and now have two quarries of their own, Oxleaze and Grange Hill, although they still process stone they buy in. They sell flooring, fireplaces and hard landscaping, as well as walling, and are keeping busy on projects ranging from four-to-five bedroom houses up to mansions.

“New houses seem to be selling quite well,” says Luke Conlon. “People are still spending. Some people might go for an oak hood or tiled cills rather than stone, but there are always people who will do that.”

Not all quarry operators are doing well in the housing market and there are plenty of complaints about the low prices that stone is being sold for, although some price rises seem to have been achieved this year to recoup some of the increased costs – especially of energy.

And there are some potential bright spots in a generally gloomy outlook for housing. For a start, the demographics that led to the level of housebuilding before the crash have not changed. Some of the Eastern Europeans who came to the UK to work might have gone home, but the population of the country is still forecast to grow by 5million by 2020 and by 11million to 73.2million in 2035, according to the Government’s Office for National Statistics.

Before the economy crashed, the Government was pushing housebuilders to increase their rate of building. Their aim then was to ease pressure on demand to deflate the housing bubble gently. One reason that did not work was the tortuously slow planning process.

Now the Government is proposing changes to those laws so planning applications have a presumption for approval. This is intended to speed up the process and result in fewer applications going to appeal, when most are usually approved but the local authority does not have to take the blame for the decision.

However, the jury is still out on whether this is going to make it easier to get planning permission or not because under the ‘localism’ theme of the proposed changes there is the promise of more say being given to local residents, who generally oppose any developments anywhere near them.

Unless the ‘localism’ aspect is simply a ploy to make the changes appear more palatable, it is difficult to see how the changes will reduce the level of conflict between people who already live in an area and those who want to make it possible for others to live there.

Little wonder, then, that those supplying housebuilding materials seem to be approximating to Heisenberg’s uncertainty principle: the better they understand their current situation the less they know about the speed and direction they are heading.