Report: Housing

Although 2010 ended as it had begun, with snowfalls that will have hit housebuilding figures for the end of the year just as they did at the beginning, there have been some encouraging signs of recovery in the market. And although people are moving less, they are carrying out improvements and having extensions built.

There are still attractive houses being built using stone from the four and five bedroom executive house up to mansions, but not as many as there used to be and stone suppliers use some choice expletives off the record to describe the housing market. They also complain about the price they can get for their stone when they can sell it.

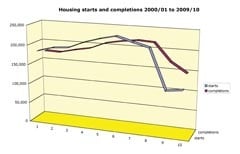

Housing completions continued to decline in the 2009/10 year according to government figures (see graph on page 28), although starts increased slightly – a trend that National House Building Council (NHBC) data show has continued this year. For the 12 months to the end of October there was a 27% increase on the same period the year before of the number of houses started – 105,100. A quarter of all those starts were in the three months August to October.

With the year ending as it started with many areas under a blanket of snow, the end of the year will inevitably see a decline in housing starts, but until the freeze hit the NHBC say the number of registrations with them to build new homes had held up, even though many builders had reported a disappointing start to the autumn selling season.

The number of homes registered in October was 10,028 – a slight rise on September’s figure (9,033), although numbers have remained consistently between 9,000 and 11,000 since April.

In the three months to October, most areas saw increases in the number of NHBC registrations. The biggest gains compared with the same period last year were in the West Midlands (up 53%) and the North (up 43%). The largest number of registrations was still in the South East, which also saw significant growth (39%).

Imtiaz Farookhi, chief executive of NHBC, says: “We have been slightly surprised by the resilience of registration volumes, given the slow start to the year, although the volumes still remain at historically low levels.

“One possible explanation is that, faced with flat or falling weekly sales per site, builders are looking to increase the number of sites they are selling off in order to maintain volumes.”

One of the major factors cited by builders for holding back the market is the lack of mortgage availability and restrictive terms for those mortgages that are available – an issue particularly for first time buyers. And when no-one is joining the bottom of the ladder it is harder for those already on it to move up.

Gross mortgage lending in October was £12.4billion, unchanged from September but down 9% on October 2009, according to data from the Council of Mortgage Lenders (CML). This is the lowest October total since 2000.

The month-on-month annual comparison is likely to continue to show a decline in November and December because underlying lending volumes rose sharply at the end of last year as borrowers rushed to take advantage of the stamp duty concession before it came to an an end with the year.

In a speech to the Council of Mortgage Lenders at their 2010 Mortgage Industry Conference & Exhibition last month (October), CML Chairman Matthew Wyles said the industry was likely to end 2010 having lent around £137billion gross, which sounds a lot but £128billion was also repaid by borrowers. Only £9billion was actually new money, indicating much of what was being lent was to existing borrowers moving house.

One difference between now and the housing market crash of the early 1990s is the low number of mortgage arrears and subsequent possessions of property by the banks. Low interest rates this time as well as fewer job losses so far are credited with making the difference. The difficulty of getting mortgages, cutting out many first-time-buyers, is also reducing lenders’ exposure to risk and the proportion of people in arrears with their mortgages fell during the year (it was 1.55% at the end of September).

Of course, not everyone needs a mortgage. People spending millions on having new houses built are not necessarily relying on mortgages. And there are still quite a number of top end houses/mansions being built. They tend to include stone and stone suppliers do not need many such projects to keep their saws, croppers and masons working.

Even further down the market, much of what is still being built is the four and five bedroom executive home in attractive areas where cropped and dressed stone is not uncommon. In 2008 more apartments were being built than houses, although there were still more houses being built than there are now. Housing now accounts for 70% of what is being built.

At Clipsham stone suppliers Stamford Stone in the East Midlands, Director George Wilson says their sales have fallen from 14,000-15,000m2 a week at the height of the market to between 7,000 and 9,000m2 this year. But he does not consider Stamford Stone are badly hit. “Fourteen-to-fifteen-thousand metres was a lot to produce,” he says.

He says Stamford Stone are reaping the benefits of the reputation they have earnt during the past 14 years of supplying what people want, on time and going the extra mile to help customers when they need it. Even so, they have not increased their prices for the past three years.

“We got an order for a site where they are building 26 houses just last week. There are still some good size houses being built. There’s one at the moment where we’re supplying £130,000 worth of stone. One of the Oxford colleges wants an extension. This snow is doing us more damage than the recession.”

Stamford Stone expanded their coverage geographically during the good times and employ six masons to provide dressed stone and architectural details as well as the walling, so they can satisfy all the stone requirements of a project – even stone for interiors, as George’s son, Dan, established Lincolnshire Limestone Flooring alongside Stamford Stone and is still finding a ready market for British limestone floors, not just in new build but also in refurbishment and extensions.

Richard Matthews at Doulting Quarry in Somerset also makes the point that although there are fewer houses being built, there is still a demand for local stone from people who are extending their homes rather than moving. As people tend to want extensions to match the existing fabric of their buildings, that benefits local quarries in areas of traditional stone building.

Prices are inevitably an issue. House prices have been up and down this year but, according to the Halifax, they fell 1.2% in the three months to October due to the biggest ever recorded monthly fall of 3.7% in September.

Builders are keen to make up the difference by paying less for their materials. And the more stone being used in a project the greater the leverage the builder has on prices. As one quarry operator told NSS: “They are making it clear if we want the job we have to put the price down. The profit margins aren’t there. I wouldn’t say it’s easy at the moment.”

Over in Herefordshire, Adrian Phillips of Black Mountain Quarries is doing well with the English stone roofing he supplies from his own quarries because the people still having work carried out are discerning and want the genuine article, but he says coursed walling has “died a death”.

Black Mountain Quarries have always imported stone roofing as well as producing their own to fill a gap between expensive British stone and concrete with a natural material. They have insisted on top quality imports, but are now also looking to introduce a ‘value range’, especially with the rise in VAT in January to contend with. “The majority of our customers would be paying VAT and everyone’s on a bit of a downer at the moment anyway,” says Adrian.