State of Trade January 2014

Stéphane Couteaud, the area sales manager for French stone machinery manufacturer Thibaut, summed it up when he said: “What’s going on in the UK and Ireland is very positive. It’s the spark that I hope will ignite all Europe.”

And what is going on in the UK and Ireland is faster growth than anywhere else in Europe.

Sales of Thibaut (and all other) stone processing machinery in the UK have taken off again as the economy improves and stonemasonry companies need efficiency improvements to keep up with demand.

The UK economy is growing strongly across the board month on month, quarter on quarter, with construction leading the way as one of the largest industries in the UK employing more than 2million people in 250,000 businesses.

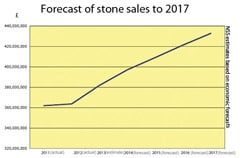

And all the predictions are for continued growth. Using a mixture of forecasts from Glenigan and the Construction Products Association as an indication of the growth of the stone industry in the years ahead shows a growth of nearly 20% between 2011 and 2017 (see graph). That will see sales of stone back above their 2008 peak.

And that might underestimate the growth in the natural stone sector, which has been taking sales from other sectors since the mid-1990s. At that time, limestone and travertine floors were a rareity, especially in domestic property; granite and engineered quartz worktops only appeared at the highest end of the market; hard landscaping was predominantly concrete with some clay. Even then the best commercial buildings were clad in natural stone, but many more of them are now, with marble, granite and limestone in the public interiors and toilets

The Millennium gave clients and specifiers a longer-term perspective on their work and now customers have seen the quality and beauty of stone they do not want to go back. There is no indication that the appreciation of stone is dwindling.

One of the drivers of the increased use of stone were falling prices as the Far East, in particular India and China, took a rapidly increasing share of the market, driven by their price advantage. There are still those who want the distinctive quality of indigenous and European stones, but there are plenty more who like the economy of imports from further afield.

Unable to compete with the low prices from the Far East, Italy, in particular, has striven to add value to its stone, with elaborate cutting and finishing – and with some success. Although the average price of stone from Italy last year was £952 a tonne, compared with £148 a tonne from the Far East, there are still those who want Italian style and quality of production and are prepared to pay for it.

And that is not only true in the UK. According to Internazionale Marmi e Macchina (IMM) Carrara, in January to September last year, Italian companies exported 3,214,718 tonnes of stone at a value of €1.4 billion. That is 3.2% more by volume and 7.2% more in value than in the same period in 2012.

The most significant area of growth was finished marble, with exports of 675,000 tonnes (+4.6%) worth €648.3million (+10.1%).

IMM Chairman Fabio Felici comments: “It is a trend that reinforces the first few months of the year and, more importantly, it is in contrast with the general trend of the economy – testifying to the international appreciation of Italian stone and the importance of the industry that creates employment and added value.”

In the UK, there are also those who want to use British stones because they are eminently appropriate in historic and sensitive settings… and some people also want to support local industry and people, especially in a recession.

In fact, many British quarries have not suffered as much as importers, not least because what has been built has tended to be at the higher end of the market by clients who are more sensitive to the materials they use… or who want to build in areas where planners are more sensitive about it.

With the UK economy growing and stone still a much sought after material in all areas of construction, there is every indication that, as M Couteaud hoped, the UK will indeed be the spark to ignite the recovery of Europe.

The wider economic background

Just look at the Glenigan* summary for 2013:

- Glenigan Index for December 2013 up 15% year on year

- Second consecutive quarter of growth in non-residential construction starts for the first time since 2010

- Retail starts double the level during the final quarter of 2012

- Civil engineering starts 41% higher than 2012

- Education project starts up by 35%.

Figures from the UK Government published in January 2014 and relating to the period to November 2013 confirm this growth trend:

- Construction output up 2.2% when comparing November 2013 with November 2012, the sixth consecutive month of year on year increase

- 3.2% increase in new work and 0.6% increase in repair and maintenance.

- Three months to November up 5.1% on the previous year

- New work up 5.3%

- Repair & maintenance up 4.7%.

The growth in housebuilding has been particularly pronounced. In the 12 months to October 2013, UK house prices increased 5.5% and in the first 11 months of 2013 (the latest figures available when this was written) public housing construction increased by 10.1% while private house construction grew 13.8 %. This is where stone floors and fireplaces, granite kitchen worktops, splashbacks and tiles, and marble and limestone bathrooms go.

The commercial private sector saw 11.5% growth in the three months to November compared with a year earlier. This produces stone’s major contracts – cladding, large areas of flooring and wall linings, reception areas, bathrooms.

In the 11 months to November last year, the stone industry had already imported more stone than it did in the whole of 2012 and was set for around 8% growth during the year.

It is no wonder the stone industry in the UK has had to invest in new machinery to meet the demand.

But it is not just new machinery that meets the growing demand. All that extra product has to be fixed onsite and growth in the construction industry rapidly translates to employment. Government figures in January showed not only that unemployment was falling but that the number of people employed in the UK has grown significantly.

The UK now has a more than 30million people working – up 485,000 from a year earlier – with unemployment down to 7.1%. The average number of hours worked has also returned to its pre-downturn peak.

Behind the figures lies a major improvement in confidence among Britain’s business community.

The Confederation of British Industry (CBI), the UK’s leading business group, is forecasting GDP growth of 2.4% in 2014 rising to 2.6% in 2015, with domestic demand supported by increases in business and housing investment and household disposable income.

John Cridland, CBI Director-General, said: “The UK is now set fair for growth, with confidence returning to Britain’s entrepreneurs. The recovery that started in the service sector has fanned out to manufacturing and construction and is shaping up to be more broad-based.”

The CBI represents the largest of British industry, but small and medium sized enterprises (SMEs, in the jargon) are also felling confident. Vistage is a support organisation the owners and top executives of businesses. Its latest survey has revealed high levels of confidence as we enter 2014.

The Vistage Confidence Index show that 73% of small and medium sized businesses in the UK and Ireland expect the economy to improve this year and 80% are preparing for a significant surge in sales.

They felt 2013 was a much better year for the UK economy, with 76% reporting improved economic conditions compared with a year earlier. At the start of 2013 confidence was a lot lower with only 20% believing business was improving.

This positive change in expectations will no doubt continue to contribute to sustainable improvements in the current economic climate, says Steve Gilroy, CEO of Vistage.

Steve Gilroy: “Germany’s medium-sized businesses are rightly feted as the reason for its economic success. By contrast, Britain’s mittelstand companies are the UK economy’s unsung heroes, despite their huge importance to a sustained recovery and sustained job-creation.”

With such a positive outlook for the coming months and years, business leaders are able to focus on making real investments in their businesses.

Steve: “Many [companies] have emerged from the economic malaise of recent years in good health and cash-rich. Our research shows they are expecting a good 2014 and most have active plans to expand their workforces to take advantage of this – in fact many are doing this already.”

*Glenigan is the provider of UK construction project sales leads, market analysis, forecasting, and company intelligence. Its clients include companies of all sizes at every stage of the construction cycle and it has strategic partnerships with The Builders’ Conference, BRE, UKCG, Constructing Excellence, CECA, HBF and GroundSure. Glenigan produces the construction industry Key Performance Indicators survey for ONS and BIS.