UK stone market continues to grow

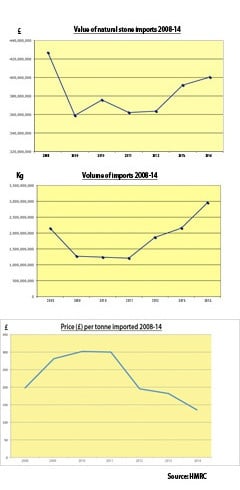

For the third successive year, the UK's imports of stone for construction and memorials grew again in 2014. Volume of imports once again outpaced the value of them, reflecting the strength or sterling and, perhaps, a hardening of attitudes by buyers.

According to the figures from HM Revenue & Customs, the value of imports last year grew a little more than 2% to just over £400million while the volume was up 37% at nearly 3million tonnes.

Because the stone sector is fairly small, fluctuations in prices and volumes are quite large because they can be influenced by a small number of projects. Nevertheless, an upward trend in the market is clear, reflecting both the growth in British construction (up 7.4% in 2014) and the economy in general (up 2.8%).

Direct imports from India and China continue to grow and for the first time last year the two countries supplied more than half the UK's stone imports. India still supplies most (nearly £127million worth last year) but China's contribution was up 5% at just over £74million.

Imports from South Korea are increasing – it supplied 2,000tonnes in 2014 worth £2million, making its price per tonne about the same as stone from Italy. More is coming directly from Latin America (2014 = 36,000tonnes valued at £12million). There is an increasing amount from the Middle East and North Africa (2014 = 17,500 tonnes valued at £10million).

From Europe, Spain has maintained its position as the UK's major supplier, not least because it ships a lot of roofing slate to Britain as well as granite for hard landscaping. In 2014 it was the source of 138,000tonnes of natural stone products valued at £58million.

Italy is Europe's largest stone trading nation but its importance as a supplier to the UK has been diminishing, slowly but inexorably, for many years. At the height of the market in 2008 it shipped 51,000tonnes of stone to the UK valued in sterling at £52million. Last year that was 31,000tonnes worth £30million.

Italy is still respected for its high quality finished stone and many developers continue to turn to Italy to source large quantities of natural materials for top-of-the-market projects, but clearly alternative sources are also being used.