Wholesalers: A vital link in the stone distribution chain

Massive changes in global communications, both physical and digital, have shrunk the world. That has altered the role of stone wholesalers in the distribution chain. But they have forged for themselves a new link in that chain to continue to support the stone processing sector. NSS spoke to some of them about their role.

Stone wholesaler Gerald Culliford was a natural stone purist, holding out against the march of engineered quartz. Then the Korean multinational giant Samsung, famous for its mobile phones, launched Radianz. “James and I had decided to stick with natural stone,” says Oliver Webb. James is James Semmens. The two of them took over from Oliver’s uncle, Simon Sands, as joint Managing Directors of Gerald Culliford in 2010.

Oliver continues: “Then my uncle telephoned and said Samsung was going into quartz. We thought if a big company like that was getting into it we should think again.” But, he says: “Our heart is always with natural stone.”

At that time (2010), following the credit crunch, London was turning to marble for kitchens and bathrooms. Marble is not ideal for kitchens because it can be etched by acids and stained by fats and other products commonly found in kitchens. It is also relatively soft, so can be scratched by kitchen utensils.

“Ten years ago we would have advised people not to use marble in their kitchens and they might have listened. Then they started saying they wanted it even after we had warned them. In the past three or four years we have put a lot of Carrara into kitchens,” says Oliver.

They are not alone and the price of good Carrara has increased, although quarries have been left with lower quality stone that they have been selling off at bargain prices to customers in the UK who don’t appreciate the difference or have restricted budgets. “We have Calacatta at £800 a square metre,” says Oliver. “You can buy a lot cheaper but ours is wonderful stuff.”

When quartz manufacturers worked out how to create a white marble look that was more resilient than the natural material it proved popular.

These days Radianz is owned by Lotte Advanced Materials, which also makes Staron solid surfaces, having been sold by Samsung a year-and-a-half ago.

Gerald Culliford, with a 9,000m2 site in Kingston-upon-Thames, Surrey, is one of the two distributors of Radianz in the UK (the other is the Thomas Group in the North) and Oliver says that quartz now accounts for about a third of Gerald Culliford sales, which are 30-40% above what they were before the economic crash. Lucerne Lake is the best seller at more than 100 slabs a month.

Another third of Gerald Culliford sales come from marble, and granite constitutes most of the rest, although earlier this year the wholesaler also took on the distribution of Sapian Stone, one of the new generation of large slab porcelains.

Quartz sales in the UK in general are growing rapidly, spurred on by the considerable marketing spend of the major players, who are helping to expand the market for hard surfaces in kitchens.

Some quartz manufacturers believe they can take a chunk of the laminate sector of the kitchen worktop market, which is still dominant. Most people would, after all, prefer to have a hard surface than a laminate. But Gerald Culliford believes porcelain has a better chance of snapping up that market because it occupies a lower price point and people who buy laminate worktops tend to be on a restricted budget.

Oliver says: “Trying to find the right product for people who want something special and for people who just buy on price is not easy.”

The Sapian Stone mobile kitchen and demonstration van, with both Sapian and Gerald Culliford staff on board, was feeding visitors at the KBB exhibition at the NEC, Birmingham, in March, when there was still snow on the ground. It was also in Gerald Culliford’s yard when the wholesaler held open days at its premises during the heat wave in June.

The Sapian Stone mobile kitchen and demonstration van, with both Sapian and Gerald Culliford staff on board, was feeding visitors at the KBB exhibition at the NEC, Birmingham, in March, when there was still snow on the ground. It was also in Gerald Culliford’s yard when the wholesaler held open days at its premises during the heat wave in June.

Oliver says sales in general this year have followed the weather, being subdued at the start of the year and picking up when the sun started shining. However, he is not expecting a major improvement until Brexit is sorted and the nervousness it brings has subsided. It was Italians who backed and helped build the Gerald Culliford company but Oliver says it might be looking to source more stone from outside Europe once the UK has left the EU.

Sapien Stone’s Area Manager, Olivier Climent, was on board his company’s kitchen display van at Gerald Culliford with the message for visitors to “dress your kitchen”.

Oliver Webb says that encompassing man-made products has been important for Gerald Culliford. It was only when the company started selling Radianz, which Oliver describes as a “sensibly priced, mid-market quartz with an exceptional finish”, that it began working with kitchen companies. And it now has displays with 150 or so in London and the South East. “Radianz took us in a new direction.”

Radianz representatives Kim Dong Hee, Sales Manager for the UK market, and business supporter for architectural products Kim Doyeon (they are not related but Kim is a common surname in the area they come from) also joined Gerald Culliford for its open days to talk to visitors about their products.

Radianz representatives Kim Dong Hee, Sales Manager for the UK market, and business supporter for architectural products Kim Doyeon (they are not related but Kim is a common surname in the area they come from) also joined Gerald Culliford for its open days to talk to visitors about their products.

And Hege Lundh was there representing the Lundh quarry company in Norway. The company has branded its Larvikites (natural Pearl granites such as Blue Pearl) under the company name, taking a leaf out of the engineered quartz companies’ book.

Hege says Lundh has its distinctive designer-made displays in 150 showrooms. “They think its good to have a natural material that’s branded. It makes it easier for them to sell,” she says.

Hege says Lundh has its distinctive designer-made displays in 150 showrooms. “They think its good to have a natural material that’s branded. It makes it easier for them to sell,” she says.

The point of a brand is that if a customer asks for a particular brand it is harder to swap it for another. It also builds loyalty. Lundh believed it could achieve that advantage by branding its stone. Gerald Culliford is one of two Lundh stockists in the UK (the other is kitchen trade supplier PWS).

During its open days, Gerald Culliford also showcased exotic granites, quartzites and onyx. James Simmonds says: “We pride ourselves on going out there and getting something special... the weird and wonderful.”

Another of the traditional stone wholesalers that originally resisted the advance of man-made products into the world of stone processing is Stephen Pike’s Marble & Granite Centre in Rickmansworth, Hertfordshire.

What changed Stephen’s mind was Lapitec, which the Marble & Granite Centre has encompassed with enthusiasm. Stephen was impressed by the look, feel and properties of the dense, sintered product supplied in jumbo-sizes from the time he was first introduced to it.

What he especially liked was that Lapitec is 100% mineral, with no resin or hydrocarbon-based binder components. Its chemistry and mineralogy is similar to a granite but with a tight, cryptocrystalline structure like Porcelain. These properties make it inert, tolerant to high temperatures (induction heaters will work through it) and frost. It is unaffected by moisture and UV light and can cope with acids, alkalis, abrasion and everyday wear and tear.

All the slabs have Lapitec’s own Bio-care applied as standard. Bio-care is titanium dioxide. It makes the surface pollution and mould resistant and is inherently anti-bacterial. It is also supplied to processors as a single stage application for cut edges to reintroduce all-round protection.

And now the Italian manufacturers have introduced an integrated colour-matched sink called the Orion 130. It is currently available in Bianco Polare, although other colour options will follow.

And now the Italian manufacturers have introduced an integrated colour-matched sink called the Orion 130. It is currently available in Bianco Polare, although other colour options will follow.

The sink is made from acrylic resin and ceramic powder, tested and validated by Lapitec to ensure uniformity of colour with its slabs. It can be paired with the Satin and Lux finishes and can be installed either integrated or undermounted.

A new link in the stone distribution chain is Bloom Stones London, established as the UK distribution arm of an Indian stone company three years ago. It took a while to become established but in the past two years under the direction of Ankur Gupta has seen sales growing at a rate of 50% a year.

Ankur is grateful for the backing the Indian company has given him in establishing Bloom Stones but the stone does not come only from India.

Ankur is grateful for the backing the Indian company has given him in establishing Bloom Stones but the stone does not come only from India.

Engineered quartz has expanded the interiors market in the UK and Bloom Stones has an own-branded range of quartz, sourced from various suppliers. But the UK market has also seen growth in exotic granites and natural quartzites and Ankur has been developing the range of these stones stocked at Bloom Stones’ warehouse in Belvedere, south of the Thames. In May, he was at the Coverings exhibition in America looking for new and unique stones to expand the range. And the range has expanded as a result.

“We try to introduce new materials,” says Ankur. “We want to be trend-setters, especially by introducing more exotics, as well as supplying all the materials our customers are already familiar with and frequently ask for.”

The aim is to offer a good choice of materials at all price points to satisfy the needs of most stone processors.

Growth continues at Bloom Stones London and when the opportunity arose to buy the warehouse next door, it jumped at it. The purchase has doubled the area of covered storage it has for stocking its stones.

It is also installing a gantry crane to make handling the slabs easier and has just invested in another seven-and-a-half tonne lorry for making deliveries.

“There’s a lot of potential in the market,” says Ankur.

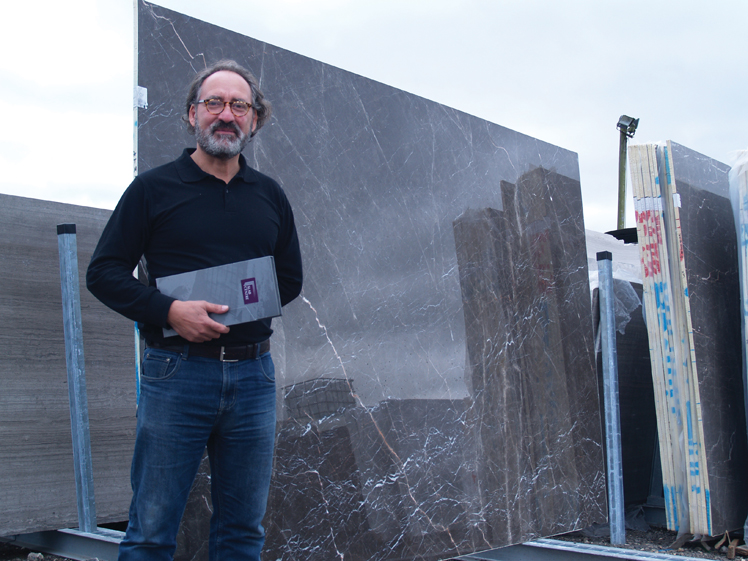

Another new name to stone wholesaling is Slab Centre, although the name behind the enterprise, Carlos Zanarotti, has been familiar in the stone industry for many years.

Carlos launched Slab Centre at the Natural Stone Show in London in April last year and says: “The very first visitor I had to the stand asked me to source 15,000m2 for them.”

Carlos launched Slab Centre at the Natural Stone Show in London in April last year and says: “The very first visitor I had to the stand asked me to source 15,000m2 for them.”

That is the market he has set out to attract. He wants to supply the sort of project that the Italians who are targeting the London market (in particular) try to win.

He says his prices are internationally competitive and “very enticing”, although in order to keep them keen he does not offer credit and will not accept returns. He says it is up to customers to view stock at his yard in Harefield, Uxbridge, just off the M25, before they buy it.

He is stocking a limited number (about 20) of popular stones in sufficient quantity to be able to supply projects from stock, so the stone is immediately available. And, he points out, he will be able to prioritise projects in the UK because he is not supplying the whole world.

This summer, Slab Centre has added Arabescato, Calacatta and Statuario marble from Italy, Moleanos white, beige and blue from Portugal, and Pietra Grey, Silver Travertine and Volakas. “These have been requested by clients. They are for orders that would normally go abroad,” says Carlos.

He says his first year in the business exceeded his expectations. “I have been privileged to have been taken very seriously by some very big players.”

He cites Sugar Quays, being jointly developed by Barratt London and CPC Group. It is on a prestigious site on the north bank of the Thames near the Tower of London. A 1970s office block is being replaced with a contemporary mixed-use Foster & Partners scheme with 165 private residential one, two and three bedroom apartments. Carlos is supplying 1,000m2 of Silk Georgette limestone. Another major project is with an American bank in the city.

“I have had developers coming along with their clients to choose the materials they want. That’s what I wanted – to have a broad appeal,” Carlos told NSS. “I’m very confident. I’m happy with my strategy. I know it’s working.”

One of the Italian companies selling to the UK is Cmp Solmar, which started stocking stone in the UK in a warehouse in London Colney, Hertfordshire, to supply the British market about 18 months ago.

Cmp Solmar was formed in 2013 from the merger of Cmp Commercio Marmi Pregiati and Solmar, two long-established Italian marble companies.

At the new company’s headquarters near Milan in Italy there is a 16,000m2 warehouse stacked with granites, marbles, sedimentary stones, onyx and travertines from all over the world.

In London Colney, more than 300 different materials are in stock.

The company says the experience of its team is its best guarantee of the high quality of the stones it sells. They visit Italian and international quarries every week to select the individual blocks Cmp Solmar wants. And the company saws and polishes the slabs from the blocks itself to ensure only top quality material is offered to national and international customers.

Slabs are photographed in high definition to provide customers with an accurate depiction of them. And, of course, customers are welcome to visit the warehouses in the UK and Italy to select materials.

Being an Italian company, Cmp Solmar has particularly good relationship with the main quarries in the Carrara area, although in addition to the Tuscan marbles (Calacatta, Arabescato, Bianco Michelangelo, Statuario Michelangelo), it also has two worldwide exclusives of its own: Valentine Grey and Valentine Red.

Nile Trading in Hertfordshire is moving into a new, 40% larger warehouse in Hemel Hempstead to cope with the growth it is experiencing.

It expects to see sales up 20% this year following its introduction of six own-branded Nile Quartz designs to complement the Kalingastone quartz from India it sells alongside its natural stones.

It says sales last year were split 60:40 in favour of natural stone, but this year that has changed to 60:40 in favour of quartz. Nile Carrara is doing particularly well. The company’s Neel Shah says: “People are absolutely loving it.”

MGLW, with its warehouse in SW8, London, is introducing a range of terrazzo slabs, designed in Italy and made in India. The company has its roots in Portugal and will be storing the majority of the slabs there so it can import in quantity for best prices. Rogerio Moutinho, who runs the UK warehouse, says the move reflects how terrazzo is growing in popularity, particularly with some high street brands.