While the mass market for housing has taken a tumble, at the top end those who can afford it have made the most of a more competitive market to build themselves a mansion in British stone.

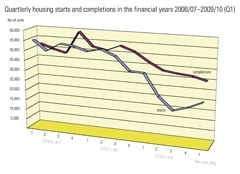

Although the number of houses started this year has increased consistently throughout the year, the increased activity follows a year which the National House Building Council (NHBC) says had the lowest number of starts since it first computerised its records in 1986.

In the face of still rising house prices in the summer of 2007 the Government set a target of building 240,000 homes a year by 2016 to help achieve its pledge of having 3million new homes by 2020. Almost immediately the number of housing starts began to fall and 2008 saw the number practically halve to 107,000.

The number of housing starts for the whole of this year will also be considerably less than in 2007 but could turn out something like last year’s figures. In October, the number of registrations with NHBC to build new homes was up again at 9,163, which was back to the July 2008 level, although by July 2008 the number of starts was already approaching half what it had been the year before.

The latest government report from the Department of Communities & Local Government was re-issued last month (November) to correct some errors in the figures when it was first published in October. It relates to the two quarters to June and shows 21,580 housing starts in the second quarter, 18% more than there had been in the first quarter but still 34% fewer than in the corresponding period of 2008.

According to the Halifax, house prices have risen every month since April this year and last month (November) were again 0.5% higher than in October.

The rolling three month period saw a slight slowing of price rises from 3.5% in the three months to October to 2.8% in November. Halifax predict prices will end the year about 5% up on the same period last year.

Prices are still more than 10% lower than they were at their peak in October 2007, but with a further 5% increase in the number of mortgages agreed last month, and a further easing of the deposit required, according to financial information service Moneyfacts, the upward trend is clearly tempting builders back on to sites.

Housing starts by registered social landlords and local authorities did not fall as much as the private sector but only account for about 10% of total starts.

In June this year the Government allocated £1.5billion for local authority housebuilding to achieve its ‘housing pledge’.

It has been argued that all governments tend to increase spending on construction projects ahead of elections because it is a way of reducing unemployment rapidly as well as injecting cash into the economy.

With David Cameron promising an emergency budget if the Conservatives win next year’s election, who’s going to bank on local authorities committing to spend much of that money ahead of the election?

Even if they do, the benefits to the stone sector will be negligible as social housing tends not to incorporate a lot of stone, either in its construction or its decoration.

The sector of the stone industry hit hardest by the fall in house building was granite worktops and other interior stonework.

With even modestly priced homes incorporating granite worktops in the kitchen and a lot of new builds having stone tiles laid over underfloor heating, and marble and limestone in bathrooms and wetrooms, a lot of companies had concentrated on that part of the market that crashed so abruptly from September 2007.

Most stone used in interiors is imported and the fall in the currency exchange rate, which increased the price of stone imported to the UK, coincided with a fall in demand that made it difficult, if not impossible, to pass on those price rises.

The squeeze on margins had the inevitable consequence and stone companies involved in kitchens and bathrooms were among the early casualties of the recession.

British quarry companies supplying the walling and masonry for houses, however, report feeling less of an impact from the recession, perhaps even benefiting from the higher price of imports that makes indigenous stone look better value.

Of course, the 100-or-more unit developments taking lorry-loads of one-tonne bags of walling at a time are in short supply, but there still seem to be enough larger houses being built, including self-builds, to keep British quarries busy.

And with the person who will live in the property more closely involved with its construction, the stone needed often includes higher value cills, quoins, string courses, pillars, ashlar and other masonry, as well as more interesting interiors, rather than just rubble walling and bog standard black granite worktops and travertine floors favoured by builders.

These better off clients can afford to be more discerning and perhaps (although suppliers have not heard customers mention it) there is even some element of wanting to use local materials to reduce their carbon footprint.

Increasingly confident planners continue to assist local stone producers in sensitive areas by insisting on local stones being used for new builds as well as renovations and extensions.

And, of course, it is still only a small proportion of houses built that actually have stone walls, so although many UK quarries have discovered the supply of walling is a good way of reducing what would otherwise be waste in the past decade or so, those supplying it are still relatively small operations that do not need many projects to keep busy.

And the people who can afford it do seem to have exploited the opportunity of keener competition among builders to have new mansions built for them, which has kept demand for indigenous stone at higher level than might have been expected.

Most quarries don’t need to be supplying the stone for many mansions to keep busy, which is why some quarry companies say they are enjoying a countercyclical increase in demand.

Stamford Stone in Barnack, Rutland, for example, say they have not felt the recession at all. The company was set up by Ivor Crowson and George Wilson specifically to supply the housing market because, being involved in the sector as customers, they had found it difficult to obtain local walling stone.

They say they are not supplying the quantities of walling stone that they were but are supplying higher value masonry. “We’ve had some big projects on,” George Wilson told NSS. “We’ve been up to our necks all the time.”

One of the projects that has helped keep them busy is the mansion J P McManus is having built in Ireland. It is using a number of stones from the British Isles, Stamford’s Clipsham Medwells among them.

But that is just one of the projects they have been supplying and, says George, they have so much work that “if we took anything else on at the moment we would be struggling”. He attributes the success to the quality of the stone… as you would.

At Doulting Quarry in Somerset Manager Richard Matthews has a similar story. At the beginning of the year they were worried about the lack of demand for walling stone, especially as Bloors had put a stop on a major development at Shepton (although there are rumours they will be resuming work there in the new year). But Doulting shifted their attention to larger projects that were going ahead and, again, received orders for higher value masonry for projects such as a big house at Nyn Park and another being built in London near Potters Bar by Linford of which Richard says: “It’s not a house, it’s more like Longleat or something.” The enquiry came from architects Purcell Miller Tritton who Doulting had worked with on Wells Cathedral.

Doulting are also supplying the stone for a significant house being built by Wells Cathedral Stonemasons and another in the Forest of Bere. “We’re up to our eyeballs at the moment,” says Richard, “especially on the sawing side – that’s doing really, really well.”

He attributes the success to the Doulting stone. “It has that little bit more character to it – either that or we’re too cheap,” he jokes.

At Black Mountain in Pontrilis, Herefordshire, where they sell imported stone as well as stone from their own quarries, owner Adrian Phillips recruited three more people to work in his own quarries at the start of the year and has taken on two more since then. He believes demand for indigenous stone has remained high because wealthier customers who are responsible for the work that is going ahead want British stone.

He says demand for the red stone from Callow Quarry that he bought in 2007 has been particularly buoyant. “It’s more browny red than the red of St Bees,” he says. “They love it in Cornwall and Cheshire.” But his other stones have also been in demand and he is just finishing the supply of 700m2 of ashlar, as well as pillars and paving, for a renovation in Abergavenny

He says Black Mountain are proactive in the market, so have gained projects as well as seeing some others fall by the wayside. He says their website has played a significant role in bringing in new work.

Larger companies are not so easily influenced by one or two projects and Warren Goodall at Stancliffe says demand for building stone “fell off a cliff” last year, although is just beginning to show signs of picking up again now. “We’re supplying two housing sites currently and some enquiries are coming in. It’s nothing like it was, but work is still going on.”