Inflation: Input prices fall 12% / house prices rise 5.5% / Easter air fares turn consumer inflation positive (just)

Consumer prices rose by 0.1% in the year to May, according to the latest figures from the Office for National Statistics. That brings inflation up from a slight negative in the year to April (-0.1%) to a slight positive. The target is 2%.

Easter in April accounts for just about all the increase in consumer inflation, with air fares rising during this holiday peak.

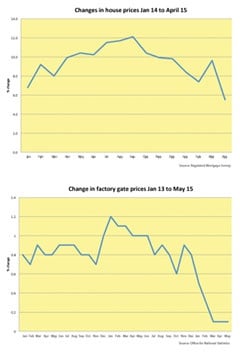

House prices continue to soar ahead, although at a slower rate as the market perhaps heads towards some kind of equilibrium. The rise in the year to April was 5.5%, down from 9.6% in the year to March.

The pace of annual house price growth fell across the majority of the UK. It was 5.8% in England, 1.3% in Wales, 2.2% in Scotland and 8.8% in Northern Ireland. The price increases in England were driven by an increase in the East of 9.6% and the South East of 8.4%.

Excluding London and the South East, UK house prices increased by 5.0% in the 12 months to April.

Deflation persists in factory gate prices of manufactured goods in general as input prices (materials and energy) continue to fall. In the year to May the output price index for goods produced by UK manufacturers (factory gate prices) fell 1.6%, compared with a fall of 1.7% in the year to April.

However, core factory gate prices (which exclude the more volatile food, beverage, tobacco and petroleum products) rose 0.1%, unchanged since March.

The overall price of materials and fuels bought by UK manufacturers for processing (total input prices) fell 12.0% in the year to May. In the year to April they had fallen 11%.