While the Italian growth of exports of raw and processed marble continues, albeit at a reduced level, exports of granite from Italy hit the buffers this year, falling nearly 10%.

The Italian stone sector has performed better than most of Italy's industry during the economic difficluties and has seen significant growth for the past five years. But in the first three quarters of 2014 that trend faltered.

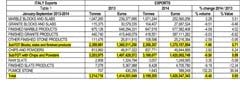

According to statistics from the Internazionale Marmi e Macchine (IMM) Carrara Research Department, between January and September 2014 Italy exported 3,199,205 tonnes of stones of all kind for a value of Euro1,426,547,343, showing a decline, albeit modest (-0.48%) in quantity exported and a small increase in value (+0.85%).

But granite exports were badly hit. Block and polished slab exports were down 9.5% by volume and value and exports of finished products fell 5% by volume and nearly 7% by value. Finished slate product exports were also badly hit, down 12% by value and 9% by volume.

The only item that has continued a good export growth rate, in quantities and values, is marble blocks and slabs, representing one third of national exports. In the three quarters to September, Italy exported 1,071,244 tonnes of marble blocks and slabs worth Euro252,560,256 – up 2.3% by volume and 5.5% by value.

The total value of exported finished marble products increased by 4.5% on the same period in 2013 (Euro677.6million) even though the quantity was down 4% (at 647,500 tonnes).

All items for granite (blocks, slabs and finished products) and finished products in other stones, however, have seen exports decline in both quantity and value.

IMM Chairman, Fabio Felici says: “As always, what weighs on Italian exports of natural stone is the trends in the area markets – the United States and the European Union in particular – and the contraction is due mainly to the reduction in exports of granite to the United States that is only partly compensated by a resumption of European imports of products made in Italy.

"The decrease in exports of granite continues a trend that has been apparent for a long while and must be read taking into account the entry of new players on important markets.

"The competitiveness of the Italian industry, on the other hand, emerges in terms of quality and value of the finished product on a demanding and mature market like the European market where exports of white marble increased in quantity and value, offsetting, although not completely, other markets.

"It is a trend that takes on different connotations according to the individual areas, but highlights how the industry has held its own and shows its competitive capacity in the quality and high added value segment."